by Ryan H. Law

About 15 years ago my wife and I moved to Indiana, excited to start a new adventure far from where we both grew up. We rented a great apartment that fit our needs and expenses. It was close to the library and shopping, not too far from my work and it had a nice pool. It was perfect.

However, after a while, we got restless. We wanted to own a home. After all, that is the American Dream, right? So we started looking for homes. We found a brand new community that was being built, and they offered 100% financing. We picked out a home we liked and put down some earnest money, then they started building it. What an exciting time!

However, after a while, we got restless. We wanted to own a home. After all, that is the American Dream, right? So we started looking for homes. We found a brand new community that was being built, and they offered 100% financing. We picked out a home we liked and put down some earnest money, then they started building it. What an exciting time!

There were some red flags, though. The first one was that we couldn’t actually qualify for the loan on our own. We didn’t have enough income or credit history. The sellers used some “creative financing strategies” to get us qualified, which involved using a tax credit that would bring our income up. We also had to get a co-signer.

Another red flag was that we had no money for a down payment or closing costs. Of course, to the seller, that was no problem. They could just roll it all in to the loan.

Another red flag was that we had no money for a down payment or closing costs. Of course, to the seller, that was no problem. They could just roll it all in to the loan.

We really couldn’t afford the payment, either, but we were excited about the home and figured if we qualified, that things would work out. We drove out nearly every day to see the progress on our home.

At some point, though, reality set in. We really couldn’t afford this home. We panicked and contacted the seller, asking to be released from our contract. Of course, they said no. We were committed. We explained that we couldn’t really afford it, but that didn’t deter them. We had a real estate lawyer look over our contract. He said he couldn’t see a way out. We weren’t sure what to do.

We got lucky, though. They had committed to have it done by a certain date, but they got behind on construction. We were able to argue that they had broken the contract, and we were therefore no longer bound by it. They let us get out of the contract and sent our earnest money back.

Perhaps they also realized that if they had forced us to follow through, we might have lost the home in a foreclosure or short sale, which would have looked bad in this brand new community.

We ended up moving shortly after that, and have been very cautious about home buying since that time. In fact, we waited more than 7 years before we actually purchased our first home.

Along the way we have learned some important lessons. Before you buy a home, I recommend you consider the following:

- Make sure your income is stable.

- Have 3-6 months’ worth of expenses in an emergency funds in the bank.

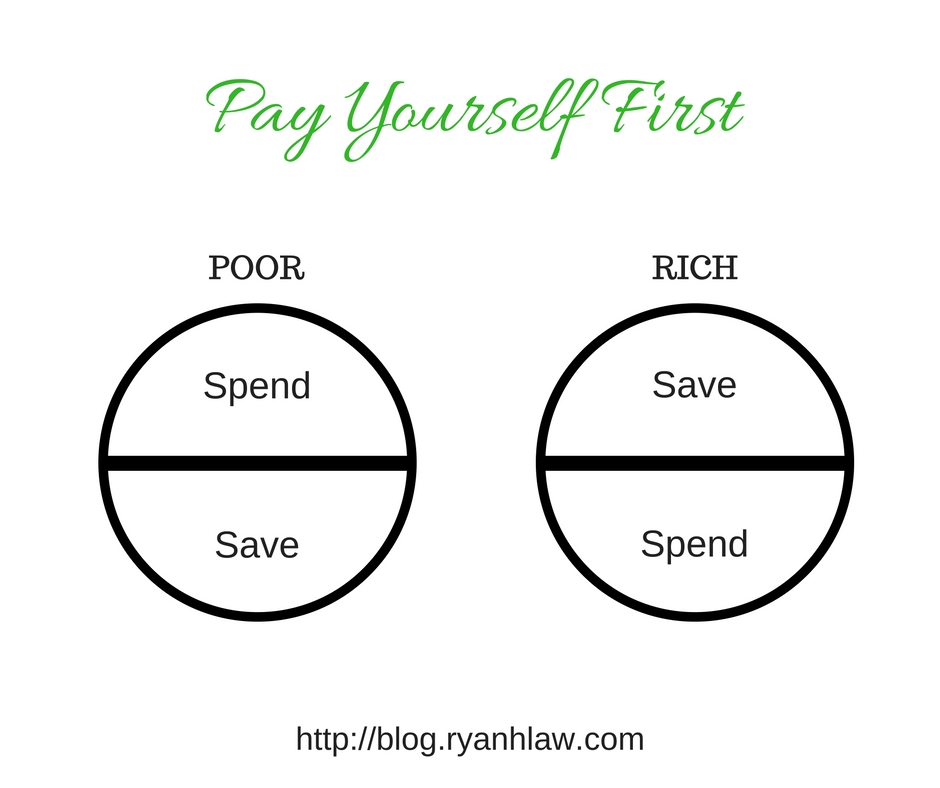

- Pay off ALL high interest debt (credit cards, vehicles, student loans, etc).

- Save up 20% for a down payment. If you put down at least 20%, you don’t have to pay Private Mortgage Insurance (PMI). PMI is generally 1% of the loan annually. On a $200,000 home that will be $2,000 per year, or $166 a month. That’s a lot to be adding to a mortgage payment each month.

- Make sure your TOTAL home cost (Principal, Interest, Taxes, Insurance, HOA fees) is no more than 25% of your take home pay. The lender will likely qualify you for much more than you can afford, but stick with your price range. Let your Real Estate agent know exactly the price range you are looking at, and stick with it. We were fortunate to find a great Realtor® in Missouri[1] who helped us find exactly what we were looking for in the price range we were comfortable with. Find someone you trust who will help you do what is best for you, not their commission.

- Remember that homes come with extra expenses. For example, if the water heater goes out in your home, you have to pay for a new one. Experts recommend that you save anywhere from 1-4% of your home’s value per year for maintenance and repairs. On a $200,000 home that is $2,000 – $8,000. While $8,000 is probably a bit high, the reality is that you will have to pay for repairs.

- I recommend that, on top of repair money, you have enough saved up to pay your insurance deductible. After all, if the roof gets destroyed in a hail storm, the insurance company will pay most of the repairs, but you have to pay your deductible first. That can be anywhere from $1,000 – $5,000.

Buying a home can be a great decision. In general, homes appreciate in value, meaning that you should be able to sell it in the future for more than you bought it for. Even that isn’t always true, though. Remember 2008? Some markets have yet to fully recover from that housing crash. Go slowly and buy what you can afford when you are ready.

[1] A shout-out to our friend and Realtor® Ted Webber: http://www.tedwebber.com/.

Share this:

However, after a while, we got restless. We wanted to own a home. After all, that is the American Dream, right? So we started looking for homes. We found a brand new community that was being built, and they offered 100% financing. We picked out a home we liked and put down some earnest money, then they started building it. What an exciting time!

However, after a while, we got restless. We wanted to own a home. After all, that is the American Dream, right? So we started looking for homes. We found a brand new community that was being built, and they offered 100% financing. We picked out a home we liked and put down some earnest money, then they started building it. What an exciting time! Another red flag was that we had no money for a down payment or closing costs. Of course, to the seller, that was no problem. They could just roll it all in to the loan.

Another red flag was that we had no money for a down payment or closing costs. Of course, to the seller, that was no problem. They could just roll it all in to the loan.