Let me share with you a few book titles on my bookshelf that have to do with money:

- Think and Grow Rich

- How Rich People Think

- As a Man Thinketh

- Mind Over Money

- Wired for Wealth – Change the Money Mindsets That Keep You Trapped

- Conscious Finance

Did you catch a theme there? It was something I hadn’t really noticed before. Clearly, according to these authors, wealth has more to do with your mindset and your thoughts than your habits.

Today’s post deals with that same concept. I am going to review the book The Five Lessons a Millionaire Taught Me About Life and Wealth by Richard Paul Evans (#1 New York Times bestselling author of The Christmas Box). I picked up a copy at the local library and read it in one sitting. It’s an easy read (93 pages of content and an additional 70 pages of resources), but definitely worth your time.

Today’s post deals with that same concept. I am going to review the book The Five Lessons a Millionaire Taught Me About Life and Wealth by Richard Paul Evans (#1 New York Times bestselling author of The Christmas Box). I picked up a copy at the local library and read it in one sitting. It’s an easy read (93 pages of content and an additional 70 pages of resources), but definitely worth your time.

Evans learned these lessons at a young age from a millionaire and went on to change his mindset, incorporate them in his own life, and make a lot of money. He teaches five lessons or principles that he says will lead all who follow them to wealth and financial independence. In fact, he says that all wealthy people share this common denominator – they understand the principles of accumulating wealth and follow them (and by wealthy he isn’t talking about those who win the lottery or inherit a fortune then go broke 5 years later, but truly wealthy people who earn and keep their wealth).

None of these principles are new – you won’t find anything earth-shattering in the five lessons. In fact, they will seem very ordinary to you. However, very few people actually follow them. I discovered areas that I can improve and plan to sit down with my wife so she and I can decide together how to better live some of these principles. I also plan to teach these principles to my children in ways they can understand.

Here are the five lessons:

Lesson One: Decide to be wealthy

Evans says this is the most important principle and that wealth is a mindset – it’s all or nothing. Bryan Tracy, another one of my favorite authors, says that it never occurs to most people that they can be wealthy and that “the primary reason for underachievement and failure is that the great majority of people don’t decide to be successful. They never make a firm, unequivocal commitment or definite decision that they are going to become wealthy. They mean to, and they intend to, and they hope to and they’re going to, someday. They wish and hope and pray that they will make a lot of money, but they never decide, ‘I am going to do it!’ This decision is an essential first step to becoming financially independent.”

Lesson Two: Take responsibility for your own money

You need to know how much money you have (by calculating your net worth monthly and annually), know where your money comes from and where it is going (budgeting). If you don’t control your money it will control you.

Lesson Three: Keep a portion of everything you earn

As George Clason says in The Richest Man in Babylon “a part of all I earn is mine to keep.” Evans says that millionaires save between 15-20% of their income and recommends that you start with a minimum of 10% of your salary and 90-100% of any side earnings.

(Consequently, the book The Richest Man in Babylon is one of my favorite books about money – you can read it for free here: http://www.ccsales.com/the_richest_man_in_babylon.pdf).

Lesson Four: Win in the margins

This principle is the one that will help you increase your nest egg as quickly as possible. The basic idea is to look for ways to increase your income and decrease your expenses. Evans goes through a number of different ways to look for deals and decrease expenses. He says that one of the best ways to save money on a purchase is to ask “Is that the best you can do?” This seems to especially be true with high-ticket items.

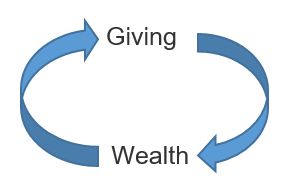

Lesson Five: Give back

Evans donates 10% (or a tithe) of his money and says that he has never felt the loss of the money but instead has felt specifically blessed for his contributions. My wife and I do the same thing and feel the same way that Evans does.

Those are the five lessons. Are you surprised at all by the simplicity? I would guess that you are. Like I said, none of the ideas are earth-shattering revelations. How many of them are you actually living, though? If you are intrigued by these ideas I highly recommend you pick up a copy of this book and make some plans to improve.

Share this: Brooks came across a statement from John D. Rockefeller where Rockefeller stated that he was rich because he gave so much, and he believed if he stopped giving that God would take his money away from him.

Brooks came across a statement from John D. Rockefeller where Rockefeller stated that he was rich because he gave so much, and he believed if he stopped giving that God would take his money away from him.

We did find out later that we weren’t quite as stealthy as we thought when she brought us some cookies, so not only did we get the benefit of feeling happy, but some nice warm cookies as well. =)

We did find out later that we weren’t quite as stealthy as we thought when she brought us some cookies, so not only did we get the benefit of feeling happy, but some nice warm cookies as well. =) [1]

[1]