By Ryan H. Law

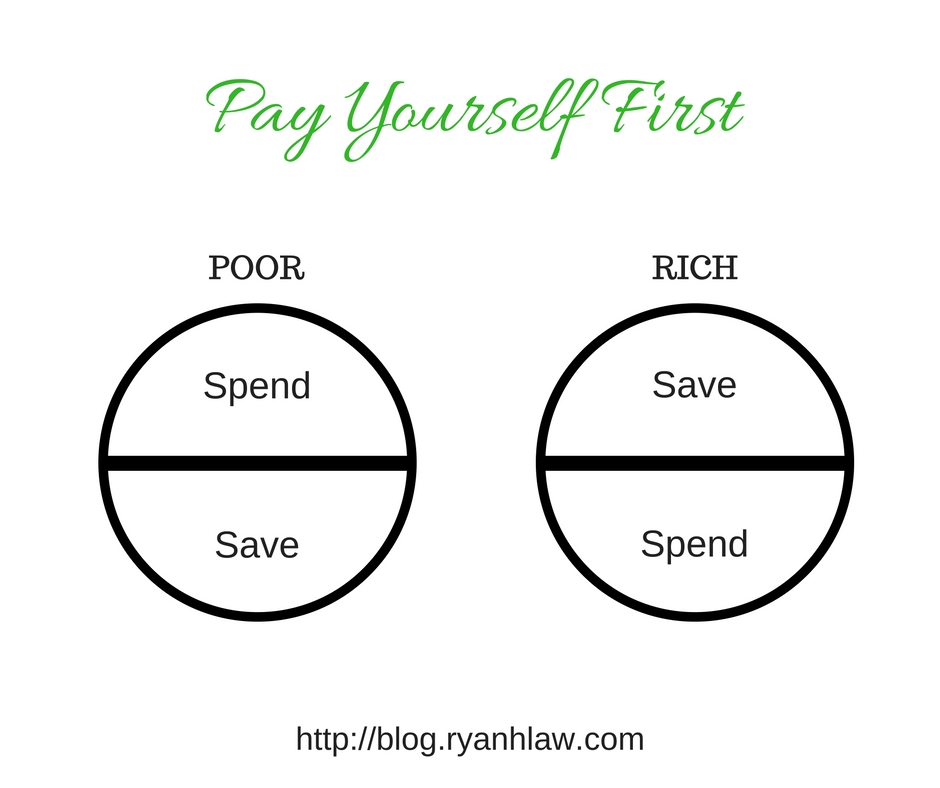

Business philosopher Jim Rohn taught that, “Poor people spend their money and save what’s left, while rich people save their money then spend what’s left.”

It’s familiar advice that we’ve all heard:

Pay yourself first.

Pay yourself first is one of the most repeated phrases about personal finances. One of my favorite financial books, “The Richest Man in Babylon”, which was originally published in 1926, repeats over and over the idea that, “a part of all I earn is mine to keep.”

But how do we actually do this? Today’s post will give you a few ideas to begin to implement this.

- Contribute to your 401(k)

If you have a 401(k) (or similar plan) available at work, this is one of the easiest ways to pay yourself first. Not only that, but in most cases this contribution will be pre-tax and will lower your tax bill.

If you have a “match” from your employer, you aren’t just paying yourself first, you are, in many cases, at least doubling your savings. If you contribute 3% and your employer matches that, you are actually saving 6%.

- Contribute to a Roth IRA

If you are eligible to contribute to a Roth IRA, it can be a great investment. Many mutual fund companies, such as Vanguard, T. Rowe Price and Fidelity, will allow you to set up an automatic transfer from your paycheck or bank account. You can often start with as little as $25 a month.

- Have a set amount (ideally 10%) transferred out of your checking account and deposited in a savings account

If your bank doesn’t allow this option, check with your employer. In most cases your employer will allow you to allow a certain amount, or a certain percentage, to go to different accounts. You can direct 10% to go to savings and the remaining amount to go to your primary checking account.

If 10% is too much, start smaller. Start with 1% or ½ of 1%. See http://blog.ryanhlaw.com/one-small-step/ for more information about starting small.