by Ryan H. Law

If you want to achieve any goal you need to where you are now, what your desired result is and the steps you need to take to get you there. For example, if a person wants to lose weight they would need to weigh themselves, set a target goal for what they want to weigh, and set up steps to get there (exercise, diet, etc.).

Knowing your numbers is important – the only way we can improve is knowing where we are today! Many of us get annual health screenings – you check your cholesterol level, blood pressure, and other health measures. If you play a sport regularly you know your speed, handicap or other important stats.

There is another number that you may not have thought a lot about but it plays a major role in your life. Here are some benefits of having a high score:

- You pay less for your car insurance

- You may get that coveted job

- You will be able to get in to the apartment you want to live in

- You will pay less (sometimes substantially less) for loans (including your mortgage, auto loans, personal loans and others)

If you haven’t figured it out already – I’m talking about your credit score. In this post I would like to discuss your credit score and why it is important for you to understand this number and how to improve it.

If you have loans of any kind in your name (personal loans, student loans, car loans, credit cards, etc.) then you have a credit file with one or more of the major credit bureaus – TransUnion, Equifax and Experian.

This file contains information about how you have repaid your loans. For each loan they show if you paid on-time or if you paid late each month (30, 60 or 90+ days late). It also shows how much of each trade line you are using (i.e. you have a credit card with a $1000 limit and you are carrying a balance of $400). If you have had more serious money problems it shows that as well – bankruptcy, accounts that have gone to collections, and unpaid liens. Finally it shows how many times you have authorized financial institutions to access your credit report (also called inquiries).

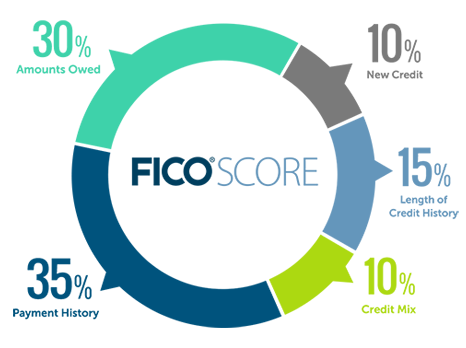

Your credit score is based off information in your credit report. Your score ranges from 300-850 (higher is better). The following graph shows how your credit score is determined:

Payment History (35%): Because this is the biggest piece of your credit score you should definitely pay attention to it. If you pay late, declare bankruptcy or have a bill go to collections you are going to see your score drop. Paying your bills on time (even if you have had problems in the past) will increase your score.

Amounts Owed (30%): This category is sometimes called your capacity – or how much open credit you have on your revolving credit lines (typically credit cards). If you have three credit cards with a total credit limit of $2500, and you carry a monthly balance of $1000, you are using 40% of your available credit. The lower that percentage, the better.

Length of Credit History (15%): This category takes into account both your oldest reporting trade line and the average age of all your accounts. Only time can improve this section, but closing old credit cards can harm your score in this section, so unless you are paying an annual fee on a card you aren’t using anymore, keep those old accounts open.

New Credit (10%): The biggest part of this is inquiries. If you are credit active (apply for a lot of credit) you are going to see a drop in your score.

Types of Credit Used (10%): Lenders like to see that you can handle a variety of loans – credit cards, student loans, car payments, a mortgage, etc.

This short video will review all five areas:

Tips for Increasing Your Credit Score

- Pay your bills on time

- If you need to be late, don’t hit the 30 day late mark

- Decrease the balance carried on credit cards and/or increase your credit limit

- Don’t close old credit accounts

- If you are rate-shopping (which is a good idea), rate shop in a 45-day window. As long as you are applying for the same time of loan at each place (i.e. a car loan) it will only count as one inquiry

- Check your credit report regularly (annualcreditreport.com) and fix any errors

- Build credit in your own name

How to Find out Your Credit Score

Unfortunately you can’t get your credit score for free through the credit bureaus. However, if you plan to apply for a loan or are applying for jobs or an apartment, it is worthwhile to pay to find out your score ahead of time.

Your banker will often pull your report for you (it will count as an inquiry on your report) but you can also purchase it directly from www.MyFico.com. There are other places (www.CreditKarma.com and www.CreditSesame.com, for example) that offer you free credit score monitoring services and are supported by ads.

In conclusion – you know your blood pressure, your golf handicap and other important numbers, but if you aren’t familiar with your credit score yet it’s time to get to know that number.

Share this:

One comment found on “Know Your Score”

One comment found on “Know Your Score”