Politicians love to talk about how long the tax code is and compare it to how long the Bible is. I found quotes of politicians who said it ranged anywhere from 2,500 pages to 1.3 million pages.

It’s actually 13,458 pages (and growing every year), and if you want to order a copy of it you can purchase all twenty volumes of the code and regulations for just $10 for your Kindle device!(1) What a bargain!

In what has to be one of the greatest marketing strategies of all time, the U.S. Government Publishing Office, where you can order a printed copy of the tax code, encourages you to “Cozy up with a book from our latest Catalog,” or in the case of the tax code, cozy up with 20 books. Happy reading!

Here’s answers to common questions to help make tax season, well, a little less taxing.

Q. How early can I file my taxes?

A. Wait to file your taxes until you have ALL your tax forms. This includes W-2s, 1099s, Interest statements, etc. Employers and companies have until February 2 to send you everything, so you should have everything shortly after that. Make a list of what you should receive and wait to start until you have it. The most common forms are:

- Form W-2: You should receive one from each of your employers

- Form 1098: If you paid interest on a home or student loan or paid college tuition you will receive a 1098

- Form 1099-DIV: If you received dividends, distributions or capital gains on any investments, watch for one of these to grace your mailbox

- Form 1099-INT: Any interest paid to you, such as interest on a CD or bank account, will be reported on this form. If you get a pink one of these, you actually win $1,000(2)

- 1099-MISC: If you did work as an independent contractor you’ll get one of these.

- If you donated to a charity they will either provide you a receipt when you donated, or an end of year statement

There’s other forms as well, but those are some of the most common ones.

Here’s a great printable checklist from TurboTax:

http://images.turbotax.intuit.com/iqcms/marketing/lib/TurboTax_TaxPrepChecklist.pdf

Q. Should I file my own taxes or have someone do it for me?

A. There’s a few different ways you can file your taxes:

- On paper

I don’t recommend this – calculations can be complicated. - Software such as TaxAct, TurboTax or H&R Block at home

Most of the top-rated software packages are simple and intuitive to use, and they are made for consumers (not accountants). You’ll enter your tax forms in and the software will do the calculations, search for possible errors, and file your taxes electronically. I personally use TaxAct. - Discount tax preparation services, such as H&R Block or Jackson-Hewitt

These companies have their place, but can be expensive for what they provide. Their tax preparers are trained, but use similar software that you can use on your own. If you want the peace of mind from having someone do your taxes, this can be a good option. - Volunteer Income Tax Assistance (VITA) or Tax Counseling for the Elderly (TCE)

VITA and TCE volunteers are I RS-certified and will file your taxes for free. You read that correct. It’s free, and there’s no catch. VITA is available for anyone that makes under $54,000, and TCE is available for those over age 60. You can find them here: https://www.irs.gov/Individuals/Free-Tax-Return-Preparation-for-You-by-Volunteers. Both VITA and TCE tend to fill up quickly, and many are first-come, first-served.

RS-certified and will file your taxes for free. You read that correct. It’s free, and there’s no catch. VITA is available for anyone that makes under $54,000, and TCE is available for those over age 60. You can find them here: https://www.irs.gov/Individuals/Free-Tax-Return-Preparation-for-You-by-Volunteers. Both VITA and TCE tend to fill up quickly, and many are first-come, first-served. - Accountant or CPA

Unless you run a business you probably don’t need an accountant or CPA to prepare your return. I have several small businesses, and we still file our own, but if your business starts to grow you should work with your accountant or CPA throughout the year.

Q. What is the due date to file my tax return?

A. It’s normally April 15, but this year it is Monday, April 18. Why? Basically it’s because Washington DC has a holiday (Emancipation Day) on Saturday, April 16, and by law when that holiday falls on Saturday or Sunday it is observed the Friday before. A federal holiday on Friday, April 15 means that tax day gets moved to the following Monday.

To close up this week’s article, I strongly encourage you to check out one of the VITA sites if you make less than $54,000 a year. Most people who uses a discount tax preparer could have their taxes filed for free instead.

One last note – don’t ever get a Tax Refund Anticipation Loan. Companies will offer to give you your tax refund right then, for a fee that ranges between $30 and $150. Don’t fall for it – if you file electronically you’ll have your refund in 1-2 weeks.

(2) Just kidding.

Share this:

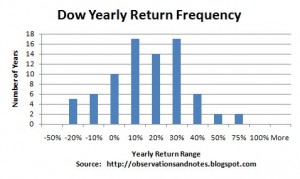

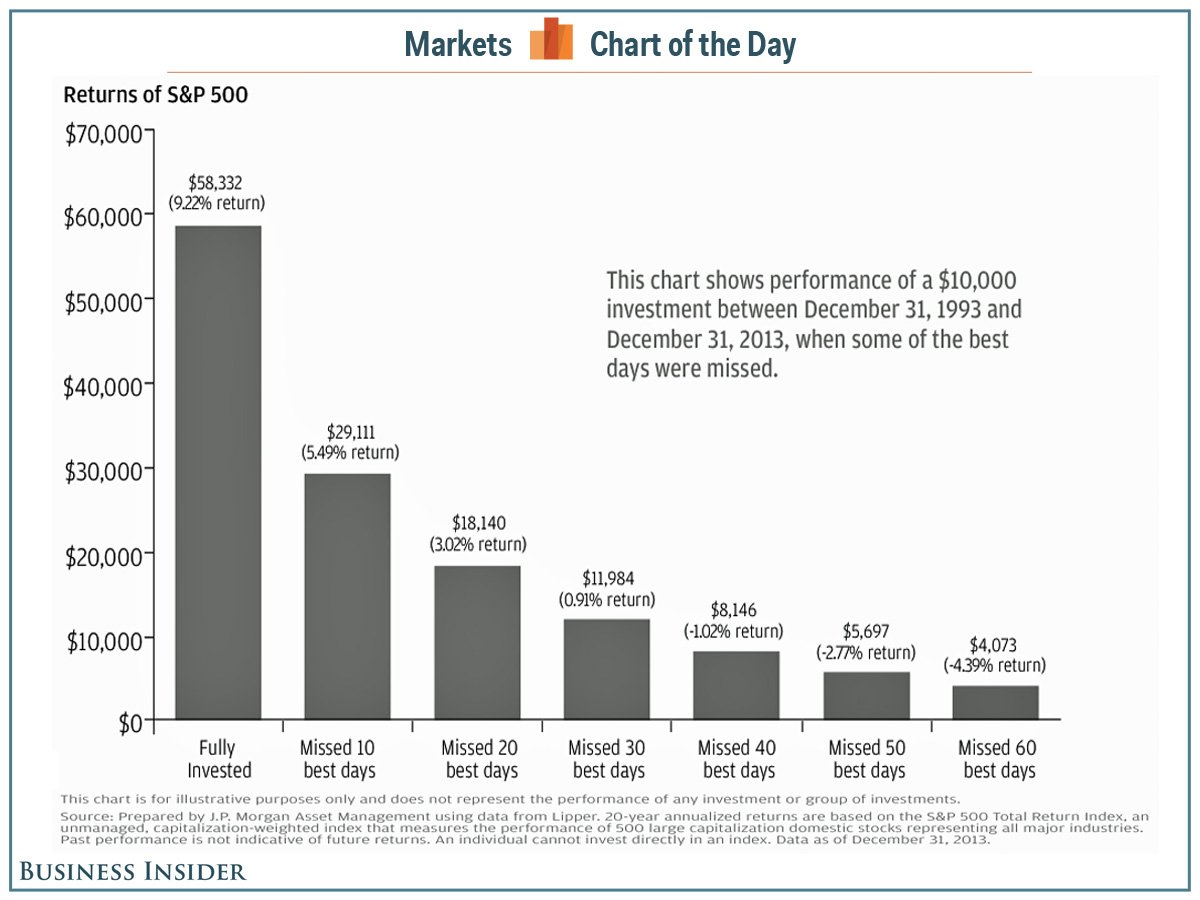

This chart assumes you invested $10,000 between Dec 31, 1993 and Dec 31, 2013. During that time the stock market had some great years and rough years.If you kept it fully invested you would have ended up with just over $58,000. If you missed the 10 best days (which often come right after the worst days) your return drops to $29,000. If you missed the 40 best days your return is actually negative – your $10,000 drops to $8,147.

This chart assumes you invested $10,000 between Dec 31, 1993 and Dec 31, 2013. During that time the stock market had some great years and rough years.If you kept it fully invested you would have ended up with just over $58,000. If you missed the 10 best days (which often come right after the worst days) your return drops to $29,000. If you missed the 40 best days your return is actually negative – your $10,000 drops to $8,147.

Brooks came across a statement from John D. Rockefeller where Rockefeller stated that he was rich because he gave so much, and he believed if he stopped giving that God would take his money away from him.

Brooks came across a statement from John D. Rockefeller where Rockefeller stated that he was rich because he gave so much, and he believed if he stopped giving that God would take his money away from him.

We did find out later that we weren’t quite as stealthy as we thought when she brought us some cookies, so not only did we get the benefit of feeling happy, but some nice warm cookies as well. =)

We did find out later that we weren’t quite as stealthy as we thought when she brought us some cookies, so not only did we get the benefit of feeling happy, but some nice warm cookies as well. =) [1]

[1]