In my last post I discussed identity theft – what it is and how to prevent it.

What about identity theft monitoring or insurance? Does it make sense to purchase it?

An important note up front – no product or company can protect you from having your information stolen. The most common way your data is stolen is through data breaches. If you have a Yahoo account, for example, some of your data has already been stolen and, as we have learned recently, it has probably been sold several times over.

That doesn’t mean there aren’t steps you can take to secure your information better (see last post for ideas), but having identity theft “insurance” doesn’t prevent your data from being stolen any more than having auto insurance keeps you from being involved in an accident.

Let’s take a look at each of the various types of identity theft protection – monitoring, insurance and recovery.

MONITORING SERVICES

Monitoring services alert you when someone else might be using your information. Services generally include:

- Tracking activity on your credit report

- Sending you an alert when your personal information (bank account, Social Security number, driver’s license number, passport or medical ID) is being used

- Access to credit reports and/or scores

No company or service can monitor all activity on all websites and merchants, but most of these companies do their best to monitor your personal information at as many places as possible.

IDENTITY THEFT INSURANCE

Identity theft insurance pays for out-of-pocket expenses incurred for recovery, which may include:

- Postage, copying and notary fees

- Less often, lost wages and legal fees

A few important notes about identity theft insurance:

- This type of insurance almost never covers stolen money or other financial losses

- There is generally a deductible

- There is no payout if the loss is covered by any other types of insurance, such as homeowner’s or renter’s insurance

- The majority of people who are involved in identity theft have almost no out-of-pocket losses. Most people pay little to nothing to copy or print things at home, postage is cheap and notary services are usually free at your bank. By the time your deductible kicks in you are unlikely to gain anything.

RECOVERY SERVICES

Recovery services help you deal with the effects of identity theft after it happens. Services generally include:

- Assigning a case manager to help you work through the process

- With some plans you actually grant authority for the case manager to act in your name, with others they guide you through the process

- Placing a fraud alert on your credit file

- Placing a security freeze on your credit file

- Helping you prepare letters to send to collectors

- Closing any tampered or fake accounts and opening new ones

Let’s take a look at two specific companies – LifeLock and Zander Insurance.

LifeLock[i]

Standard protection is $10 a month or $109 annually. Prices go up to $29.95 a month for premium services.

Basic services include:

- Website surveillance

- Cancel credit cards if stolen

- Send alerts when your information is being used

- Replace stolen funds up to $250,000 (only what the bank won’t replace)

- Spend up to $1,000,000 on lawyers, accountants or others to restore your previous status

Zander Insurance

Zander is $75 year ($6.76 a month) for an individual or $145 a year ($13 a month) for family protection.

Zander operates their protection plan on the premise that financial identity theft is only one of more than 15 types of identity theft. There is also Social Security, criminal, employment, medical, tax refund and other types of fraud, many of which won’t be discovered by monitoring. In many cases you won’t know you have been a victim until you get a letter from the IRS or a doctor bill or even a warrant for your arrest.

Their focus is on identity theft recovery. Services provided include:

- Up to $1,000,000 reimbursement for any stolen bank funds or unauthorized electronic funds transfer (only what the bank won’t replace)

- Unlimited legal fees if needed

- $0 deductible

- Contact banks, bureaus, insurance companies and doctors for you

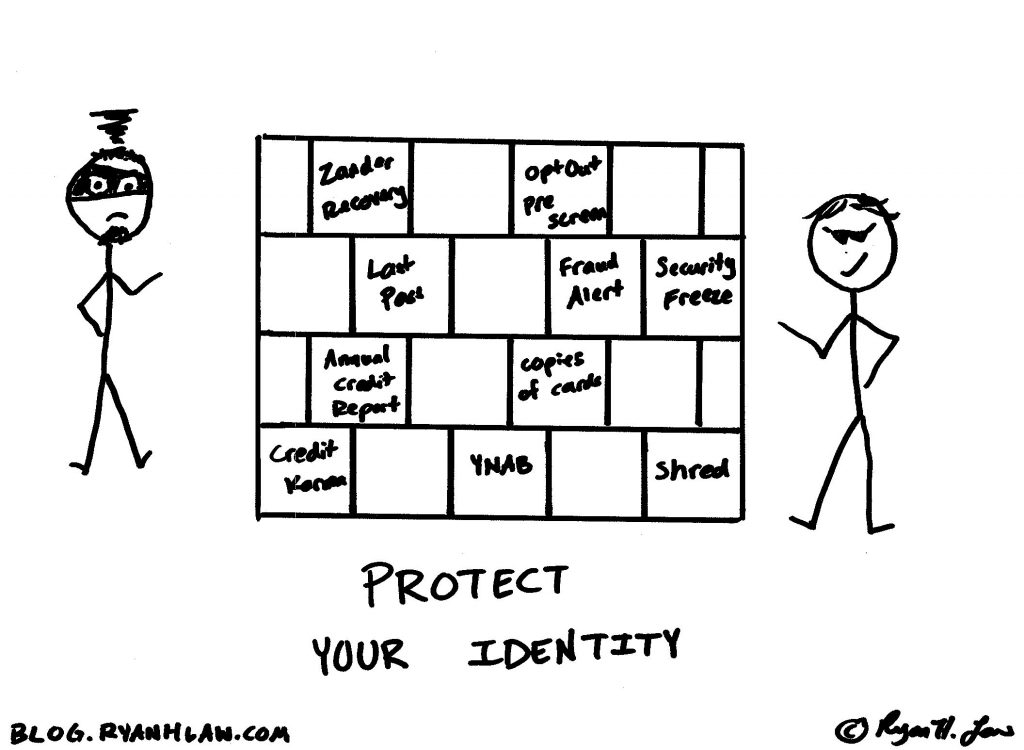

What I Recommend

No strategy is perfect, but this is my plan:

- Use CreditKarma.com for monitoring (they send me an e-mail anytime something changes on my credit report)

- Use YNAB (youneedabudget.com) to review my bank and credit card transactions daily

- Shred any documents with financial or personal information

- Use https://www.optoutprescreen.com/ to stop receiving most pre-screened credit card offers

- Put a security freeze on my credit bureau reports

- Check one credit report every 4 months on annualcreditreport.com

- Copy the front and back of all cards in my wallet

- Use a service such as LastPass.com to manage and use different, secure passwords on each website

- If my wallet is stolen or I am a victim of a breach place a 90-day fraud alert on my credit bureau accounts

- Sign up for Zander’s plan for recovery services (I believe it is worth the $145 a year for the services they will provide)

If you have taken all of these steps but choose not to sign up for recovery services, the FTC has created a new website that will help you recover. It generates pre-filled letters and walks you through exactly what you need to do to recover. You can find the website at http://www.identitytheft.gov.

[i] For both LifeLock and Zander be sure to review their services before signing up. Services may have changed since this article was written.

Share this: If you live in an apartment and a candle tips over and starts a fire, who is responsible for the damage? What if a thief breaks in and steals your TV and other electronics? Is your landlord responsible to replace those items?

If you live in an apartment and a candle tips over and starts a fire, who is responsible for the damage? What if a thief breaks in and steals your TV and other electronics? Is your landlord responsible to replace those items? One of the easiest ways to save some money is to do an occasional review of auto and homeowners insurance. Last week I wrote about auto insurance (

One of the easiest ways to save some money is to do an occasional review of auto and homeowners insurance. Last week I wrote about auto insurance (